Economic growth is estimated at 4.9% in 2013 and is projected to accelerate to 5.7% in 2014.

Having witnessed drastic currency depreciation and rapid inflation in 2011, the economy experienced stability for both indicators in 2012 and 2013 with inflation dropping to a single digit. This stability is expected to continue in 2014.

Kenya’s economy continued to recover in 2013 from the slowdown experienced in 2011. Real GDP growth in the year accelerated to 5.2%, 4.3% and 4.6% in the first three quarters of 2013 primarily driven by financial intermediation, tourism, construction and agriculture.

Real GDP growth is estimated at 4.9% and 5.7% in 2013 and 2014 respectively. Similarly CPI inflation is expected to remain single digit over the same period. The economy’s short- to medium-term forecast is for sustained and rising growth based on: increased investor and business confidence in the wake of peaceful March 2013 elections; increased rainfall; a stable macroeconomic environment; lower, stable international oil prices; stability of the Kenya shilling; and reforms affecting security, governance and justice.

Political activity in 2013 mainly centred on trials at the International Criminal Court (ICC) and the general elections held on 4 March 2013. Trials of three Kenyans, including the president and his deputy, continued at the ICC in The Hague, The Netherlands. They are accused of committing crimes against humanity during the post-election crisis of 2008. The March 2013 elections saw intensive competition between two main coalitions seeking the presidency, various gubernatorial seats and seats in parliament and county assemblies. Eventually, the Jubilee Coalition led by Uhuru Kenyatta and William Ruto was declared the victor after a fierce legal challenge before the Supreme Court from the Cord coalition, led by former Prime Minister Raila Odinga and former Vice President Kalonzo Musyoka.

Kenya is integrated into a number of global value chains – e.g. floriculture, textiles, leather, manufacturing and tourism – but economic and social benefits have been limited due to insufficient or unsustainable linkages with other sectors.

NAIROBI, KENYA:

Significant public investment in infrastructure, increased agricultural

production and expanding services in Africa's retail, telecoms,

transportation and finance sectors are expected to continue to boost

growth in the continent.

This increase in growth is expected to occur despite lower commodity

prices and lower foreign direct investment as a result of subdued global

economic conditions, according to the World Bank's new Africa's Pulse

report.

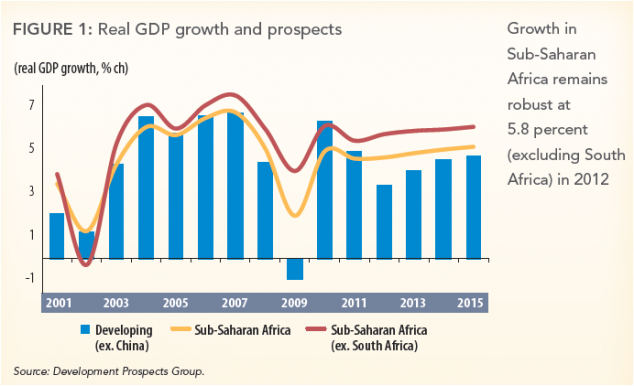

The report indicates regional Gross Domestic Product ( GDP) growth is

projected to strengthen to 5.2 per cent yearly between 2015 and 16 from

4.6 per cent in 2014.

Africa's Pulse, a twice-yearly analysis of the issues shaping Africa's

economic prospects, indicates that commodity prices remain highly

significant to Africa's outlook. Primary commodities continue to account

for three-quarters of Sub-Saharan Africa's total goods exports.

"The share of the region's top five exports in total exports climbed to

60 per cent in 2013 from 41 per cent in 1995," the report noted.

World Bank's Chief Economist for Africa Francisco Ferreira noted that

overall, Africa is forecast to remain one of the world's three fastest

growing regions and to maintain its impressive 20 years of continuous

expansion.

"Downside risks that require enhanced preparedness include rising fiscal

deficits, economic fall-outs from the activities of terrorist groups

such as Boko Haram and Al-Shabaab and, most urgently, the onslaught of

the Ebola epidemic in West Africa," he said.

In a study of patterns of structural transformation and poverty

dynamics, the report finds that Africa is largely bypassing

industrialisation as a major driver of growth and jobs.

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

NAIROBI, KENYA:

Significant public investment in infrastructure, increased agricultural

production and expanding services in Africa's retail, telecoms,

transportation and finance sectors are expected to continue to boost

growth in the continent.

This increase in growth is expected to occur despite lower commodity

prices and lower foreign direct investment as a result of subdued global

economic conditions, according to the World Bank's new Africa's Pulse

report.

The report indicates regional Gross Domestic Product ( GDP) growth is

projected to strengthen to 5.2 per cent yearly between 2015 and 16 from

4.6 per cent in 2014.

Africa's Pulse, a twice-yearly analysis of the issues shaping Africa's

economic prospects, indicates that commodity prices remain highly

significant to Africa's outlook. Primary commodities continue to account

for three-quarters of Sub-Saharan Africa's total goods exports.

"The share of the region's top five exports in total exports climbed to

60 per cent in 2013 from 41 per cent in 1995," the report noted.

World Bank's Chief Economist for Africa Francisco Ferreira noted that

overall, Africa is forecast to remain one of the world's three fastest

growing regions and to maintain its impressive 20 years of continuous

expansion.

"Downside risks that require enhanced preparedness include rising fiscal

deficits, economic fall-outs from the activities of terrorist groups

such as Boko Haram and Al-Shabaab and, most urgently, the onslaught of

the Ebola epidemic in West Africa," he said.

In a study of patterns of structural transformation and poverty

dynamics, the report finds that Africa is largely bypassing

industrialisation as a major driver of growth and jobs.

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

NAIROBI, KENYA:

Significant public investment in infrastructure, increased agricultural

production and expanding services in Africa's retail, telecoms,

transportation and finance sectors are expected to continue to boost

growth in the continent.

This increase in growth is expected to occur despite lower commodity

prices and lower foreign direct investment as a result of subdued global

economic conditions, according to the World Bank's new Africa's Pulse

report.

The report indicates regional Gross Domestic Product ( GDP) growth is

projected to strengthen to 5.2 per cent yearly between 2015 and 16 from

4.6 per cent in 2014.

Africa's Pulse, a twice-yearly analysis of the issues shaping Africa's

economic prospects, indicates that commodity prices remain highly

significant to Africa's outlook. Primary commodities continue to account

for three-quarters of Sub-Saharan Africa's total goods exports.

"The share of the region's top five exports in total exports climbed to

60 per cent in 2013 from 41 per cent in 1995," the report noted.

World Bank's Chief Economist for Africa Francisco Ferreira noted that

overall, Africa is forecast to remain one of the world's three fastest

growing regions and to maintain its impressive 20 years of continuous

expansion.

"Downside risks that require enhanced preparedness include rising fiscal

deficits, economic fall-outs from the activities of terrorist groups

such as Boko Haram and Al-Shabaab and, most urgently, the onslaught of

the Ebola epidemic in West Africa," he said.

In a study of patterns of structural transformation and poverty

dynamics, the report finds that Africa is largely bypassing

industrialisation as a major driver of growth and jobs.

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

Read more at: http://www.standardmedia.co.ke/business/article/2000137534/world-bank-optimistic-about-africa-s-economic-growth-despite-challenges

Comments

Post a Comment